Additional Resources

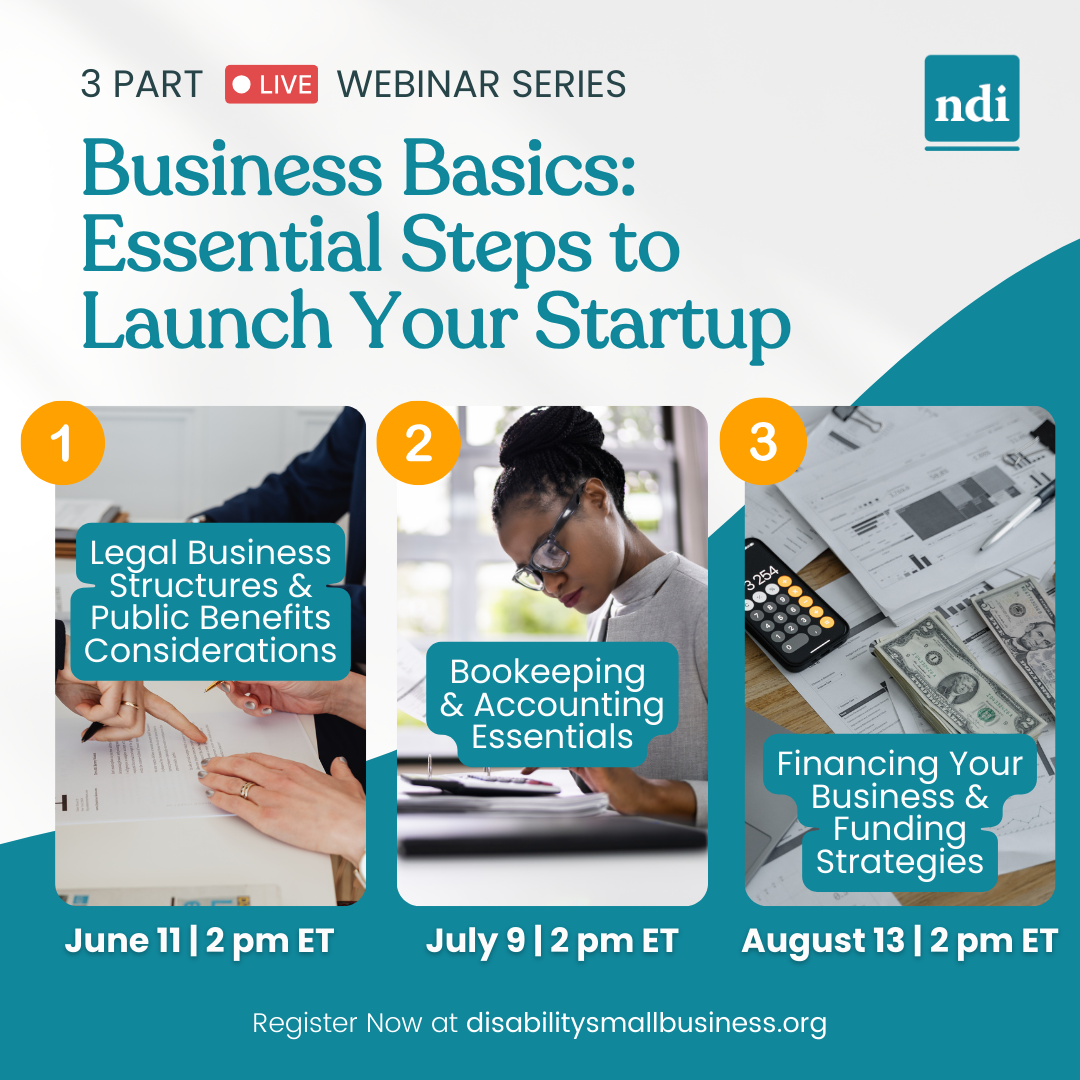

Business Basics: Essential Steps to Launch Your Startup (3-Part Series)

Business Basics: Essential Steps to Launch Your Startup (3-Part Series)

Starting a business is more than just having a great idea, it requires careful planning and the right foundation. This three-part webinar series will guide you through the essential steps to structure, protect and fund your business. Join industry experts as they share key insights to help you successfully launch your business with confidence.

Please Note: Materials from each session will be available 1-2 weeks after the live event.

Session 1: Legal Business Structures & Public Benefits Considerations (ARCHIVE)

Learning Objectives:

- Choose the right legal structure (LLC, S-Corp, Sole Proprietorship)

- Understand how SSI, SSDI and public benefits impact business owners

- Select the best tax structure for your business

Archived Event Materials

- View the Zoom recording with shared screen

- View the recording on YouTube

- View and download the presentation slides

- Download the transcript

Session 2: Bookkeeping & Accounting Essentials for Startups (ARCHIVE)

Learning Objectives:

- Learn bookkeeping, tax basics and obligations for sole proprietors and single-member LLCs

- Learn the importance of having a separate personal and business banking account to keep business financials organized.

- Learn how to obtain an EIN for free

- Gain understanding the basic concepts of cost of goods, revenue, expenses and profit

- Identify common tax mistakes that entrepreneurs can avoid.

Archived Event Materials

- View the Zoom recording with shared screen

- View the recording on YouTube (coming soon)

- View and download the presentation slides

- Download the transcript (coming soon)

Session 3: Financing your Business & Funding Strategies

Date/Time: August 13, 2:00 PM – 3:30 PM ET

Learning Objectives:

- Explore funding options for your business, such as loans or grants

- Build banking relationships

- Learn about CDFI’s and how they can support your financial business needs

- Build credit and financial security for business growth

Who Should Attend?

- Aspiring entrepreneurs and new business owners

- Small business owners looking to strengthen their financial and legal foundation

- Professionals supporting entrepreneurs as they start, build or grow their businesses

ASL Interpretation and Captioning will be provided. To make a reasonable accommodation request or if you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org. Please allow at least 3-5 business days’ advance notice; last minute requests will be accepted, but may not be possible to fulfill.

Set your business up for success. Register today!

The contents of webinar were developed under grant H421F240198 from the U.S. Department of Education (Department). The Department does not mandate or prescribe practices, models, or other activities described or discussed in this document. The contents of this webinar may contain examples of, adaptations of, and links to resources created and maintained by another public or private organization. The Department does not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. The content of this webinar does not necessarily represent the policy of the Department. This publication is not intended to represent the views or policy of or be an endorsement of any views expressed or materials provided by any Federal agency. (EDGAR 75.620)

All personal data will be kept confidential, and we will not share individual demographic data with any third party. National Disability Institute (NDI) collects data to help secure future funding to create programs that serve the community.

Empower Your Business with ABLE

Entrepreneurs and small business owners with disabilities face unique financial challenges and ABLE accounts can be a game-changer. This session will explore how ABLE accounts support business owners in 2025 and beyond, helping you maximize financial security while maintaining essential benefits.

If ABLE isn’t yet a part of your business strategy, now is the time to learn how it can enhance both your financial future and your employees’ success.

Topics Include:

- ABLE account eligibility

- ABLE Plan features

- Contributions & the ABLE to Work provision

- Work-Related Qualified Disability Expenses

- How ABLE can serve as a financial resource for employees

ASL Interpretation and Captioning were provided. If you have questions about this session, please email info@disabilitysmallbusiness.org.

Watch on YouTube (coming soon!)

View and download the PowerPoint Slides

The contents of webinar were developed under grant H421F240198 from the U.S. Department of Education (Department). The Department does not mandate or prescribe practices, models, or other activities described or discussed in this document. The contents of this webinar may contain examples of, adaptations of, and links to resources created and maintained by another public or private organization. The Department does not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. The content of this webinar does not necessarily represent the policy of the Department. This publication is not intended to represent the views or policy of or be an endorsement of any views expressed or materials provided by any Federal agency. (EDGAR 75.620)

Small Business Innovation Research/ Technology Transfer (SBIR/STTR) Masterclass

Presented By: Kimberly Mozingo, Vice President, Federal Programs, TEDCO

Accessing research and development funds to enable future growth and commercialization can be extremely challenging. A potential option is obtaining funding through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. This informative session provides an overview of these federal programs, including eligibility criteria, application processes and the benefits of securing SBIR/STTR funding. Learn how to leverage these programs to drive innovation and growth in your small business.

ASL Interpretation and Captioning will be provided. To make a reasonable accommodation request or if you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org. Please allow at least 3-5 business days’ advance notice; last minute requests will be accepted, but may not be possible to fulfill.

ASL Interpretation and Captioning were provided. If you have questions about this session, please email info@disabilitysmallbusiness.org.

View and download the PowerPoint Slides

The contents of webinar were developed under grant H421F240198 from the U.S. Department of Education (Department). The Department does not mandate or prescribe practices, models, or other activities described or discussed in this document. The contents of this webinar may contain examples of, adaptations of, and links to resources created and maintained by another public or private organization. The Department does not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. The content of this webinar does not necessarily represent the policy of the Department. This publication is not intended to represent the views or policy of or be an endorsement of any views expressed or materials provided by any Federal agency. (EDGAR 75.620)

Filing a Tax Return for your Business, Tax Tips for the Self-Employed

The goal of this session is to help small business owners go into the upcoming tax season prepared with a strong money-saving tax filing strategy. Topics of discussion include tax forms and deadlines, 2025 tax updates, understanding why money is owed to the IRS, how business structure directly affects tax strategy, home office business expense and what is deductible vs. non-deductible.

Presented by Talibah Bayles, Founder & CEO of TMB Tax and Financial Services Benefit Corporation Powered by Bankably.

ASL Interpretation and Captioning were provided. If you have questions about this session, please email info@disabilitysmallbusiness.org.

View and download the PowerPoint Slides

The contents of webinar were developed under grant H421F240198 from the U.S. Department of Education (Department). The Department does not mandate or prescribe practices, models, or other activities described or discussed in this document. The contents of this webinar may contain examples of, adaptations of, and links to resources created and maintained by another public or private organization. The Department does not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. The content of this webinar does not necessarily represent the policy of the Department. This publication is not intended to represent the views or policy of or be an endorsement of any views expressed or materials provided by any Federal agency. (EDGAR 75.620)

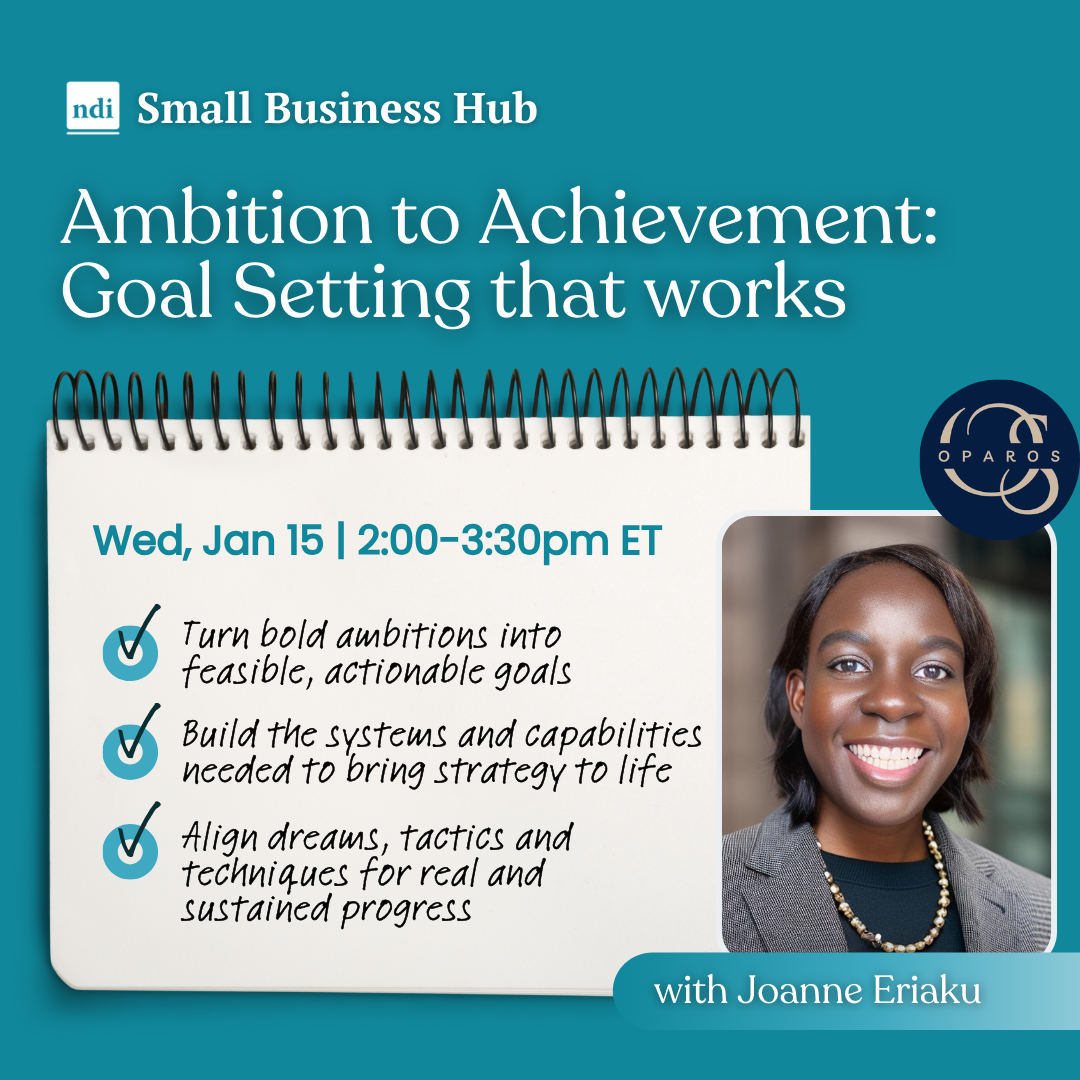

Ambition to Achievement: Goal Setting That Works

Ambition is great, but ambition without feasibility is failure in disguise. Around this time of year, you’re setting goals for your business—brainstorming, whiteboarding, and daring to dream big. But without the right structure, capabilities, and systems, those goals risk remaining just that—dreams.

So, what does it take to translate ambition into actual impact? What does it take to turn bold goals into real success?

It takes an integrated set of choices, capabilities, and support systems—in other words, it takes an engine to drive your goals forward.

The Business Goal Engine (BGE) is a powerful framework of six interconnected, interdependent elements designed to move you from ambition to achievement.

Join us for the Ambition to Achievement Masterclass, where you’ll learn how to:

- Turn bold ambitions into feasible, actionable goals.

- Build the systems and capabilities needed to bring strategy to life.

- Align dreams, tactics, and techniques, for real and sustained progress

This isn’t just about dreaming big—it’s about winning smart. Whether you’re planning for 2025 or the decade ahead, this masterclass will provide the clarity and tools you need to turn ambition into achievement and vision into real, lasting impact.

ASL Interpretation and Captioning were provided. If you have questions about this session, please email info@disabilitysmallbusiness.org.

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

View and download the PowerPoint Slides

The contents of webinar were developed under grant H421F240198 from the U.S. Department of Education (Department). The Department does not mandate or prescribe practices, models, or other activities described or discussed in this document. The contents of this webinar may contain examples of, adaptations of, and links to resources created and maintained by another public or private organization. The Department does not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. The content of this webinar does not necessarily represent the policy of the Department. This publication is not intended to represent the views or policy of or be an endorsement of any views expressed or materials provided by any Federal agency. (EDGAR 75.620)

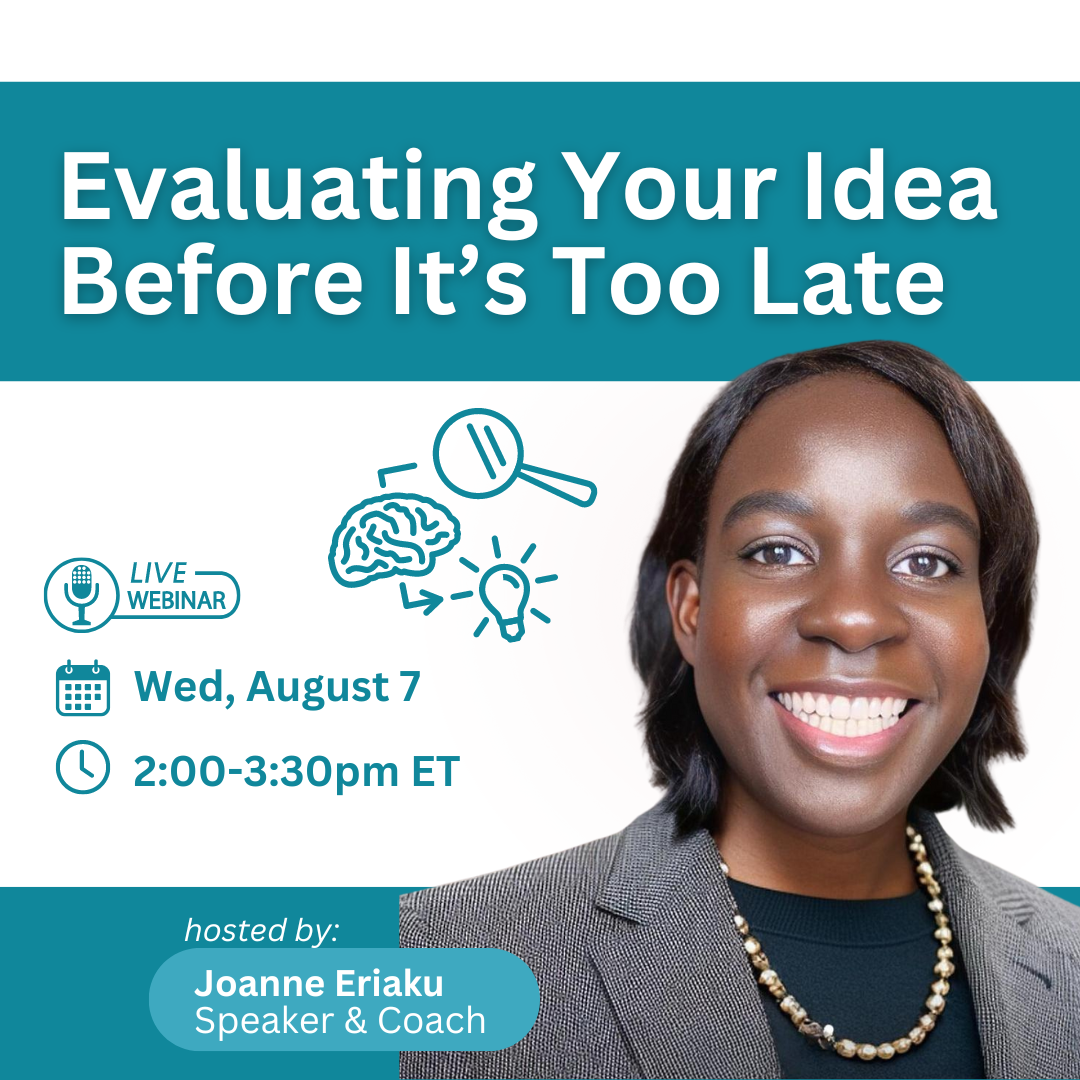

Evaluating Your Idea Before It’s Too Late (The Job-To-Be-Done Way)

How do you know if you’re onto something? And how do you assess its viability before investing time, resources, and energy? Enter the Job-To-Be-Done (JTBD) framework—a powerful methodology for understanding customer needs and designing solutions that resonate.

In this practical session, we dive deep into the approach. You will walk away with the practical toolset and skillset required to ensure you’re on the right track before making significant investments.

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

View and download the PowerPoint Slides

ASL Interpretation and Captioning were provided. If you have questions about this session, please email info@disabilitysmallbusiness.org.

Disability Owned Convening

National Disability Institute’s Small Business Hub held its third annual Disability Owned Convening on November 20-21, 2024. This unparalleled virtual event brought together entrepreneurs and small business owners with disabilities, entrepreneurial support organizations, policymakers, financial institutions and disability advocates from across the country.

Whether you’re an established small business owner or just starting out, this convening offers invaluable opportunities to gain actionable advice, expand your network and hear from successful entrepreneurs sharing their knowledge and insights. Sessions will cover a wide range of topics including pathways to financial resources, technology tools and business organization and marketing, allowing you to create a personalized learning experience.

What participants have said about the Disability Owned Convening…

“I had no idea there were so many people who experience disabilities, some fairly significant and closer to mine, who were business owners! Thank you, guys, for putting that on! It left me wanting more.”

“I’ll be honest, I couldn’t stop listening! Excellent resources and speakers!”

“I was extremely intimidated about starting a business with the intense health challenges I have been facing… After watching the sessions, my hope was rekindled that I too can succeed as a small business person.”

“Great information. Many of us have ideas for a small business, but most of the time they stay just ideas. We don’t always know all the things that need to be considered before starting a business, which is why many of us fail or don’t start at all. This really focused on the important aspects and great strategies.”

Subscribe to the newsletter to stay informed about registration, speakers and more details!

Visit the website archive to watch recordings from the last three years.

The contents of webinar were developed under grant H421F240198 from the U.S. Department of Education (Department). The Department does not mandate or prescribe practices, models, or other activities described or discussed in this document. The contents of this webinar may contain examples of, adaptations of, and links to resources created and maintained by another public or private organization. The Department does not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. The content of this webinar does not necessarily represent the policy of the Department. This publication is not intended to represent the views or policy of or be an endorsement of any views expressed or materials provided by any Federal agency. (EDGAR 75.620)

EARN Small Business Webinar Series: Local and State Disability Inclusion Incentives and Resources for Small Businesses

01:00 PM – 02:00 PM Eastern

Did you know that many local and state governments provide incentives and resources to small businesses to meet their workforce needs with talent with disabilities? These incentives and resources help the business hire and retain workers with disabilities. Local and state governments offer various supports, such as tax incentives or reimbursement for the cost of workplace accommodations. Many small businesses can benefit from these – and similar support may exist in your area.

In this webinar, learn about innovative state and local programs that help small businesses tap into a talented and diverse workforce and promote inclusivity with minimal cost. Experts from Minnesota’s Employer Reasonable Accommodation Fund and the City of Tacoma, Washington Department of Finance will offer participants the reasons to and guidance on developing and implementing such a program. The benefits of these programs will also be discussed.

During this webinar, participants will learn more about:

- A local program providing tax incentives for supporting small businesses to meet their workforce needs with talent with disabilities

- A state government-funded program that provides financial assistance to employers to cover accommodations for disabled employees

- Ways to build mutually beneficial relationships between small business, community organizations, and state and local governments

ASL and real-time captioning will be provided.

Please reach out to EARN if you have any questions about this event at: earn@askearn.org.

National Symposium on Quality Employment 2024

Hosted by the Vocational Rehabilitation Technical Assistance Center for Quality Employment

Registration is Now Open!

When: May 22 and 23, 2024

Location: Grainger Hall, 975 University Avenue

Madison, Wisconsin or Virtually on Zoom

Cost: Free, registration required.

CRCs: Certified Rehabilitation Counselors (in-person and attending virtually) can earn a total of 15 CRC CEUs, of which nine will qualify for ethics credits

Join us in Person or Virtually!

If you have an accommodations request or a dietary restriction, please register by 3/30/24.

Strengthening Your Small Business: Certification Funding and Growth Opportunities

Explore certification benefits and funding programs for small, minority, and women-owned businesses. Learn about MBE, DBE, ACDBE and SBE certifications, along with SBA funding options like 7(a) loans, 504 Loans, Microloan Programs and more. Gain insights into crafting effective loan proposals and credit management strategies. Plus, discover how to seek and apply for grants and access valuable resources for business growth. Don’t miss this chance to propel your business forward!

During this workshop you will learn how to:

- Obtain Certification

- Access Funding

- Network and Connect at No Cost

- Maximize Marketing

To make a reasonable accommodation request or if you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org. Please allow at least 5 business days’ advance notice; last minute requests will be accepted, though may not be possible to fulfill.

Addressing Barriers to Opportunity for Diverse Suppliers

Diverse and emerging businesses often find it cost-prohibitive to meet requirements like cyber security, insurance, and bonding when bidding for corporate business. Too many otherwise-qualified businesses are prevented from securing contract opportunities due to the high cost of compliance, creating a very real barrier to entry. LISC manages the Emerging and Diverse Supplier Financing Program aimed at providing businesses with the access to capital they need to secure corporate contracts. Our goal is to create an industry-wide solution that will remove common obstacles to doing business and contribute to building generational wealth in diverse communities nationwide. Learn about this innovative new program during our webinar.

Presented by: Yvonne Durbin, Director of the Capital Innovation Lab for the Strategic Investments (SI) group at Local Initiatives Support Corporation (LISC)

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

View and download the PowerPoint Slides

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

Beyond Our Disabilities – Celebrating Black Disabled Entrepreneurs

“Beyond our Disabilities – Celebrating Black Disabled Entrepreneurs” is an empowering event dedicated to showcasing the tenacity and innovation of Black entrepreneurs with disabilities. This event, in collaboration with National Disability Institute (NDI) and Financial Joy School, offers the inspirational stories of determination and success from founders who have triumphantly navigated a variety of challenges. The event will be hosted by the charismatic Ruby SunShine Taylor and feature a panel of outstanding entrepreneurs, including Mariah Barber from Invisible Strengths, Dr. Samantha Scott of JuneBrain and Stephanie Thomas of Cur8able.com. Join us for an afternoon of celebration, insights and appreciation for these extraordinary individuals who have turned obstacles into opportunities for growth and achievement

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

View and Download the PowerPoint Slides

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

EXIM 101 – Export Essentials for Successful Global Business Growth

Are you aware that there is a Government agency specifically there to support you in taking your business to a global consumer base? The EXIM bank is the official export credit agency of the United States. Their mission is to support American job creation, prosperity and security through exporting. Attend this webinar to learn about EXIM finance tools, how you can reduce non-payment risk, and expand to other countries.

For more information about Export-Import Bank of the United States (EXIM), visit the website.

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

View and download the PowerPoint Slides

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

GHA Training: Blending Funding for Self-Employment

This session will provide viewers with an example of a business owner who used several funding streams and resources to launch their business. The example will include details about the business owner’s experience, including lessons learned, as well as provide a brief explanation of each funding source. The session will include featured guests comprised of the business owner and other key team members.

Presented by Griffin-Hammis Associates

Guest Speakers:

- Rachel of Rachel Rasnick Art

- Michael of Red, White & Brew and Budding Violet

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

View the slides from Rachel Rasnick and Michael Coyne

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

GHA Training Series: Reporting Business Activity for SSDI/Medicare

This session will explain the timing and process for reporting the start of a business and ongoing business activity for SSDI and Medicare, including Medicare financial assistance programs. This session will also explain how Social Security reviews an SSDI beneficiary’s work activity and the documentation an SSDI beneficiary should keep and be prepared to submit to Social Security.

Presented by: Griffin-Hammis Associates

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

Preparing for Accessing Capital

During this session, Karlene Sinclair-Robinson, Director of CBP’s Business Finance Center, will address the capital challenges small business can face, and explore how to prepare for capital and strategies for accessing it. Community Business Partnership (CBP), based in Springfield, Virginia, is one of the organizations certified by the U.S. Department of Treasury’s CDFI Fund. They are also a Small Business Administration’s Approved Intermediary Microlender, and a Virginia Small Business Resiliency Lender. The organization focuses on lending to small businesses, startups, and individuals seeking to start up micro-enterprises. The CBP provides loans starting at $1,000 to qualified applicants in their geographically approved markets.

Karlene started with CBP as a client 18+ years ago and evolved to where she supported the organization’s lending mission to bringing the current loan funds and programs to the community. Karlene is considered an Alternative Financing Expert and is a speaker on numerous topics impacting the small business community.

Presented by: Community Business Partnerships

Watch the Zoom Recording (with shared screen and gallery view)

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

GHA Training Series: Reporting Business Activity for SSI/Medicaid

This session will explain the timing and process for reporting the start of a business and ongoing business activity for SSI and Medicaid. This session will also explain how Social Security adjusts the SSI benefit based on projected net earnings from self-employment and reconciles the benefit payments after the business tax return is completed.

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

Is Owning a Business a Good Fit for You?

Completing this class is an important step towards deciding whether you should start a business. After completing this class, you will be able to:

- Clarify some of the myths and realities of small business ownership.

- Start a self-assessment to determine your readiness to become a small business owner.

- Set a plan of action to complete your self-assessments by seeking feedback from stakeholders, such as family, friends, and potential customers.

- Have exclusive access to grant opportunities and professional consulting and mentorship 1:1.

- Learn more about various business resources and program opportunities.

Register here: https://startup2023.eventbrite.com

Sign up for Verizon Small Business Digital Ready.

To make a reasonable accommodation request or if you have questions about this event, please email Ruth Chavez at rchavez@ndi-inc.org. Please allow at least 3-5 business days’ advance notice; last minute requests will be accepted though may not be possible to fulfill.

Is Owning a Business a Good Fit for You?

Completing this class is an important step towards deciding whether you should start a business. After completing this class, you will be able to:

- Clarify some of the myths and realities of small business ownership.

- Start a self-assessment to determine your readiness to become a small business owner.

- Set a plan of action to complete your self-assessments by seeking feedback from stakeholders, such as family, friends, and potential customers.

- Have exclusive access to grant opportunities and professional consulting and mentorship 1:1.

- Learn more about various business resources and program opportunities.

Register here: https://startup2023.eventbrite.com

To make a reasonable accommodation request or if you have questions about this event, please email Ruth Chavez at rchavez@ndi-inc.org. Please allow at least 3-5 business days’ advance notice; last minute requests will be accepted though may not be possible to fulfill.

GHA Training Series: Net Earnings from Self-Employment and SSDI/Medicare

This session will explain how net earnings from self-employment (NESE) affects SSDI and how an SSDI beneficiary can have more income when self-employed. A brief explanation of SSDI work incentives will also be provided. In addition, the affect NESE has on Medicare and the Medicare financial assistance programs will be discussed.

Presented by Griffin-Hammis Associates

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

Guardianship and Self-Employment Listening Session

We held a listening session to learn how guardianship or supported decision making (SDM) can facilitate or be a barrier to self-employment for people with disabilities. We invited people with disabilities and their parents who have started down the path of self-employment and have a guardian/SDM. We were interested in hearing about your experiences.

ASL Interpretation and Captioning were provided. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

This event was not be recorded for public viewing.

Is Owning a Business a Good Fit for You?

Learning Objectives

After completing this class, you will be able to:

- Clarify some of the myths and realities of small business ownership.

- Start a self-assessment to determine your readiness to become a small business owner.

- Set a plan of action to complete your self-assessments by seeking feedback from stakeholders, such as family, friends, and potential customers.

- Have exclusive access to grant opportunities and professional consulting and mentorship 1:1.

- Learn more about various business resources and program opportunities.

Register here: https://startup2023.eventbrite.com

GHA Training Series: Funding Your Business

In this session, we share ideas for funding your business start-up. Each business and business owner has unique start-up needs, as a result most business owners combine multiple sources for start-up funds to launch their business. We invite featured guests to share how they funded their businesses, what resources they recommend, and how they communicate their funding needs to meet their individual start-up needs.

Presented by: Griffin Hammis Associates

Guest Speakers:

- Jane Jonas of Eyeth Studios and Lost River Vacations

- Renee Metro of Fulcrum Stained Glass

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

View and Download the Presentation Slides

View and Download Renee’s Slides

Watch the Lost River Vacations Video

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.

GHA Training Series: Business Structure & Business Plan

This session touches on two pivotal parts of starting a business: choosing a business structure & navigating the business plan. In this time together, we will provide a brief overview of the common business structures, important benefit considerations for choosing a business structure, and an overview and importance of a business plan. We’ll learn and understand how our featured guests chose a business structure that best serves them and how they use their business plan as working document to help them grow and maintain their business.

Presented by Griffin Hammis Associates

Guest Speakers:

- Thad Brown of VASLA

- Sherry Wynn of Just Fix This Mess

Watch the Zoom Recording (with shared screen and gallery view)

Watch the Webinar on YouTube (with corrected captions)

ASL Interpretation was provided by Interpreter Now and Captioning was provided by Caption First. If you have questions about this session, please email Alexis Jones at ajones@ndi-inc.org.